How’s Your Log Supply Chain?

Article by Dan Shell, Managing Editor, Timber Harvesting July/August 2022

EDITOR’S NOTE: The following editorial ran in the May 2022 issue of Timber Processing magazine and was sent to more than 10,000 mill owners, managers and operators.

In between looking for extra employees to fill out another shift or solidify the one or two already in place, or perhaps looking for larger vaults to hold the cash they’ve been putting away thanks to record lumber prices, lumber suppliers would be smart to take a look at the health of the supply chain feeding their mills. Ensuring all those nice equipment investments meet projections and ROI numbers requires a consistent flow of quality timber.

A mill’s relationship with its contractors or log sources can vary widely as well, from gatewood contractors to “closely held” contractors who work almost exclusively for a given mill or mills. There are also all sorts of financial arrangements with contractors, from cosigning loans to outright buying equipment to fronting repair work—we’ve heard it all.

Most of the time it works as suppliers, customers, vendors and markets mesh. Of course loggers will quickly say they’re getting paid the same prices as 20+ years ago, while procurement people will point out timber is a commodity product. Years ago I remember a forester say the true cost of logging lies somewhere between a company crew and lean-running independent contractor. Probably so.

But no matter how you look at it, both loggers and mills have the same logistical goal: Get the logs to the mills. And just as mills have been hit with labor and supply chain issues, loggers have as well as the entire industry grapples with pandemic impacts that continue, no matter how much we believe and want to be “over it.”

Add the recent inflation run-up and loggers are taking it on the chin: According to a recent survey by the American Loggers Council, in the past year logging contractors have seen an average 25% cost increase across 20 items such as parts and equipment, and some items like fuel much more. Also, more than two-thirds (69%) of loggers have seen labor price increases of 20% or more.

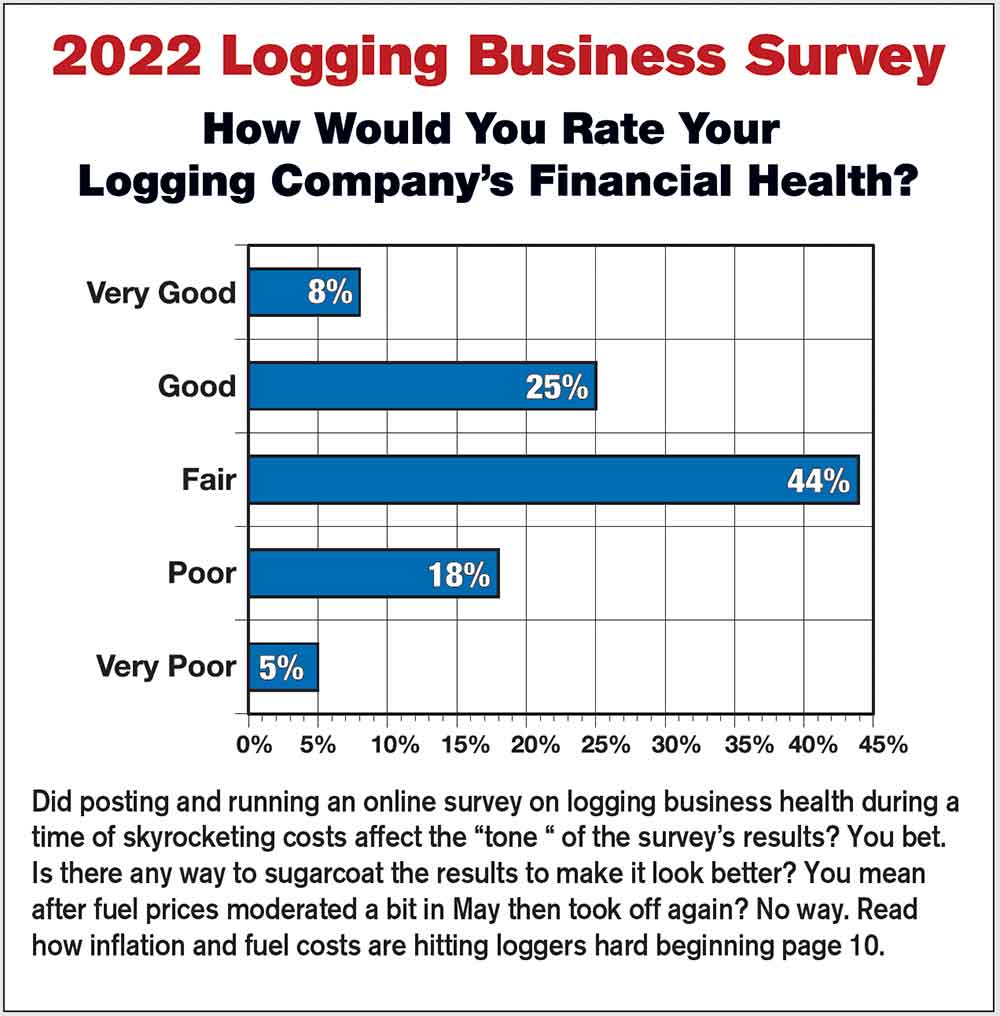

Meanwhile, a recent Timber Harvesting magazine 2022 Logging Business survey shows 40% of loggers either broke even or lost money the past two years, and one out of five loggers (21%) rated their business health as poor to very poor. From a list of a dozen different issues, logging rates and log markets finished #1 and #2, respectively, when loggers were asked their top business concerns.

This is not to make the mills out as the bad guys, as almost half (49%) of loggers report price increases the past two years. While it shows some mills are stepping up, it may not be enough across the supply chain. Even with the rate increases almost two-thirds of loggers (60%) reported passing up opportunities to expand in the past two years because of labor issues.

Looking ahead, even more ominous trends are on the horizon: Almost half (46%) of logging contractors are age 60 or over, and almost three-fourths (71%) are 50 or older. It’s those ages that are driving the results of another question, as 37% of those who responded say they are planning to get out of logging in the next five years.

One issue for loggers is there’s no clear path for growth, from the commodity price structure to the inability to pass along cost increases. As one logger commented, what business would make the kind of million dollar investments that loggers do with returns of barely 3% and an inability to pass along costs? Not many.

At TP we’re all about exploring the latest technology and noting the investments mills make to apply it. There’s the old saw among old time sawmillers that the best log is the cheapest log, but as the industry continues to grapple with labor and supply chain issues, perhaps the best log is a healthier one for all segments of the forest industry.

Latest News

President Trump Signs Order To Expedite Timber, Lumber Output

President Trump Signs Order To Expedite Timber, Lumber OutputOn March 1, President Donald Trump signed a far-reaching executive order directing agency heads to develop ways to increase the output of...

Maine Biofuels Plant Permitting In Process

Maine Biofuels Plant Permitting In ProcessOfficials with the Castlerock Biofuels plant in Millinocket, Maine say permitting is in process and much of the engineering complete for the “biocrude”...

BC Government Refocuses On Timber Sales

BC Government Refocuses On Timber SalesThe British Columbia, Canada government has launched a review of BC Timber Sales (BCTS) to ensure BC’s forestry sector is continually evolving to overcome...

WANT MORE CONTENT?

Spanning seven decades since its inception in 1952, Timber Harvesting highlights innovative and successful logging operations across the U.S. and around the world. Timber Harvesting also emphasizes new technology and provides the best marketing vehicle for the industry’s suppliers to reach the largest number of loggers in North America and beyond.

Call Us: 800.669.5613