July / August 2024

Loggers Adapting To Changing Industry

Results from the 2024 Timber Harvesting Logger Survey show an industry undergoing wrenching change around the country. In addition to the challenges of operating highly capitalized businesses in mostly rural areas, many with relatively shallow labor pools, and in an environment of rising costs for all business inputs, loggers are also grappling with a major shift in pulp-paper markets that are throwing the standard contractor’s business dynamics seriously out of whack.

INSIDE THIS ISSUE

COVER STORY

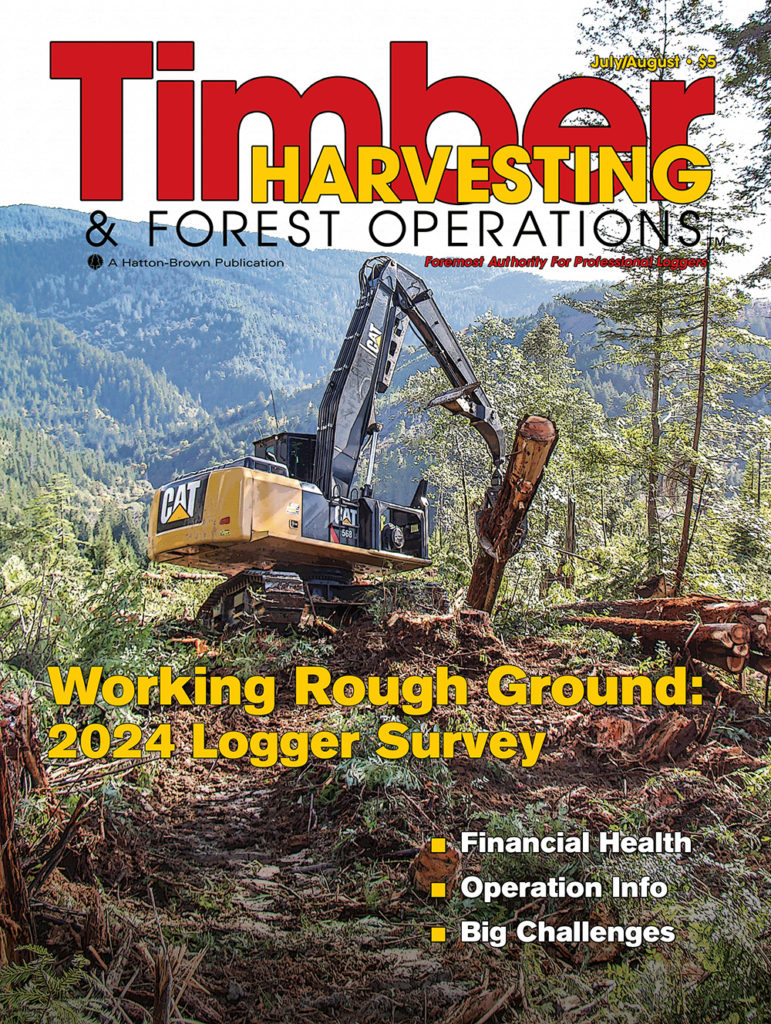

Working Rough Ground: 2024 Logger Survey

My Take: One Load Rolling/Curriculum Counts

Interstate I-65 is a continental funnel that brings thousands upon thousands of tourists from across the country to the snow white beaches of Florida and Alabama, and by the time they all get on the road south of TH headquarters in Montgomery, sometimes it seems like a solid wall of traffic going 70+ MPH.

Newslines

- Novo BioPower Contracts Ensure Biomass Operations

- ALC, FS Sign MOU Noting Mutual Benefits

- Murrelet Issues Affect Coastal Oregon Project

- Carbon Offset Market Leader Loses License

- New Northwest Pellet Mill Moves Forward

- Lake States Expo

- Billerud Cancels Expansion, Still Committed to Facility

- Coal Co-Fire Plant Going To 100% Biomass, CCS

- Michigan Biomass Power Plant Closing Despite Order

- Canfor Purchases El Dorado Sawmill

Safety Alerts

- Take Extra Care Avoiding Rigging Crew Accidents

Lucas Barden Logging

This past year has been notably challenging for the forest industry, and northern Florida is no exception. The logging communities there have felt a profound impact following significant operational shifts at two major mills.

Virginia Biomass

In the 2023 General Assembly session of the Commonwealth of Virginia, HB2026 and SB1231 amended the Virginia Clean Economy Act (VCEA) to enable woody biomass to continue to be used as a source of electric power generation in Virginia and for specific biomass energy facilities to be included as eligible sources in the renewable energy standard.

New Technology

- John Deere

- Tigercat

- Ponsse

- Forest Chain

- Skidderwindows.com

- White Mountain Chain

- Precision Husky

Equipment World

- Demo Day Done Right

- Titan Upgrades Iowa Ag, Forest Tire Facility

- TimberPro’s Crawford Announces Retirement

Select Cuts

- Allied Angle

- Sennebogen Names TEC Top Tree Care Dealer

- Peak Renewable Opens Pellet Mill In Dothan

- Kronospan Adds P’Board Capacity

- New CLT Plant Planned For Western Oregon

- Mendocino NF Details Fire Management Plans

- RoyOMartin Develops New Leaders

Loggers Adapting To Changing Industry

Fiber market issues hit contractors hard.

Results from the 2024 Timber Harvesting Logger Survey show an industry undergoing wrenching change around the country. In addition to the challenges of operating highly capitalized businesses in mostly rural areas, many with relatively shallow labor pools, and in an environment of rising costs for all business inputs, loggers are also grappling with a major shift in pulp-paper markets that are throwing the standard contractor’s business dynamics seriously out of whack.

Timber Harvesting has tried to follow the story as it’s developed but among pandemic issues and market swings and inflation, beginning in 2020 there have been more than 22 announcements of pulp and paper mill and paper machine closure announcements that have taken at least 30 million green tons a year in pulpwood and chip consumption off the market.

Those contractors who have been servicing those mills now either have no work through the mill’s procurement department or no markets if they were buying their own timber. (For example, G-P’s Foley paper mill that closed last fall in Perry, Fla. took in 1,100 loads a week.)

These are high-volume markets, and unfortunately that’s what loggers are told to do to overcome low cut and haul rates: make it up on volume. Well, for many loggers the volume just isn’t there any more.

And the hits just keep on coming: In its most recent issue the North American Woodfiber & Biomass Markets newsletter notes recent news from the American Forest & Paper Assn. that pulpwood consumption fell 9% in 2023 and is expected to fall again this year.

The reasons? Long-term demand reduction in certain paper grades and also a shift away from green fiber and roundwood in general in favor of more recycled raw material.

And it’s a problem that feeds on itself: With more producers scrambling to unload pulp and fiber wood it drags prices lower for all in markets across the country. And this is just a fairly educated guess by the TH brain trust, but looking at the numbers and results of this year’s survey, almost every logger has been affected by the fiber wood downturn, but somewhere around a third of loggers have been heavily and adversely impacted by reduced pulpwood markets.

WANT MORE CONTENT?

Spanning seven decades since its inception in 1952, Timber Harvesting highlights innovative and successful logging operations across the U.S. and around the world. Timber Harvesting also emphasizes new technology and provides the best marketing vehicle for the industry’s suppliers to reach the largest number of loggers in North America and beyond.

Call Us: 800.669.5613